Key Benefits of SCF

- Operates independently of any Loan Origination System (LOS) or Loan Management System(LMS), with integration options available through accessible APIs.

- Specifically designed to manage Bill Discounting, Receivable Finance, and Distributor Finance seamlessly.

- Streamlines operations, eliminates redundancies, and strengthens collaboration among stakeholders.

- Enhances efficiency, reshaping your processes for maximum productivity.

- Maintains detailed, accessible records to ensure transparency and accountability.

- Supports end-to-end digitization with customizable dashboards and reports tailored to management requirements, allowing for better data analysis and strategic planning.

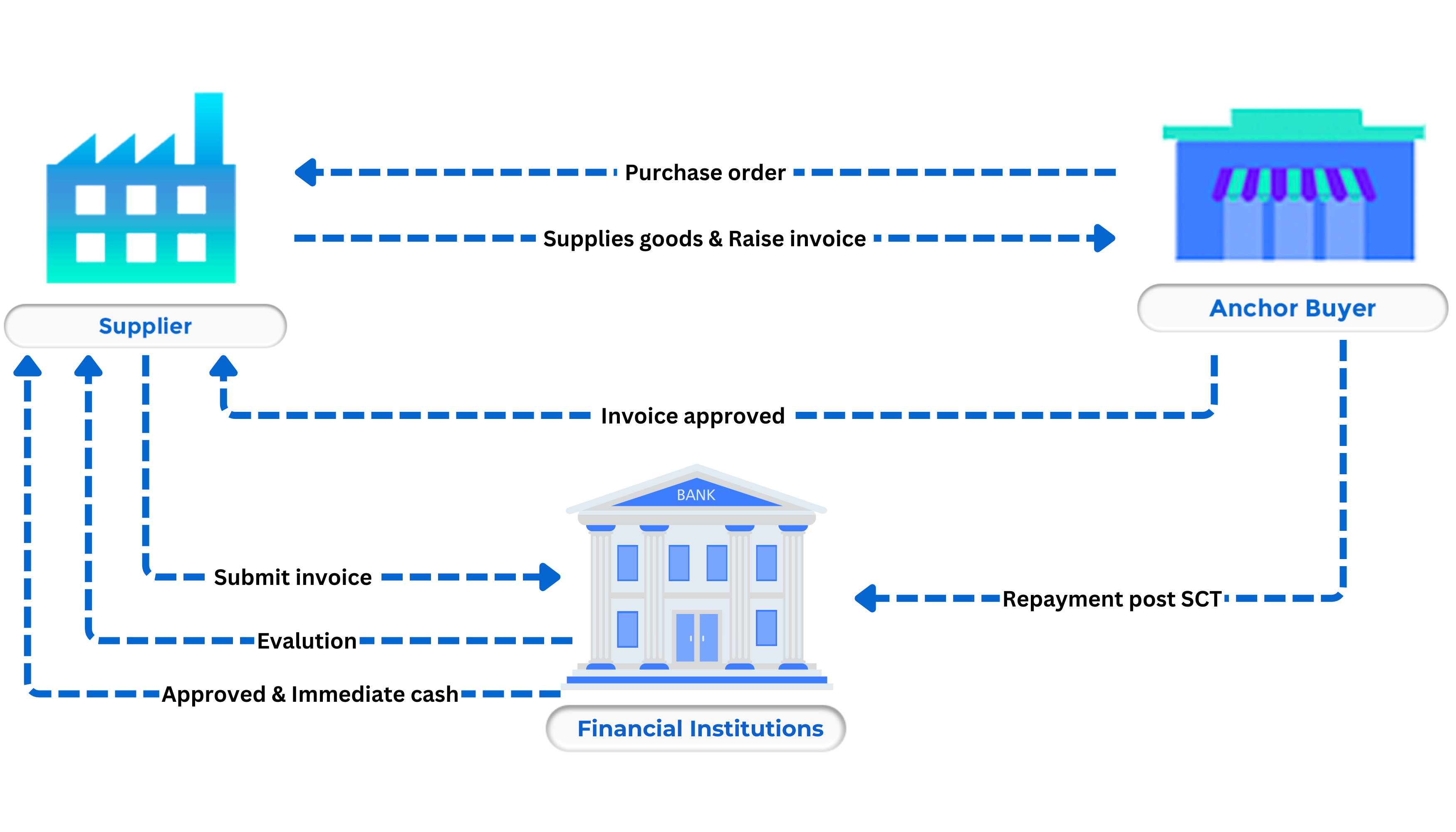

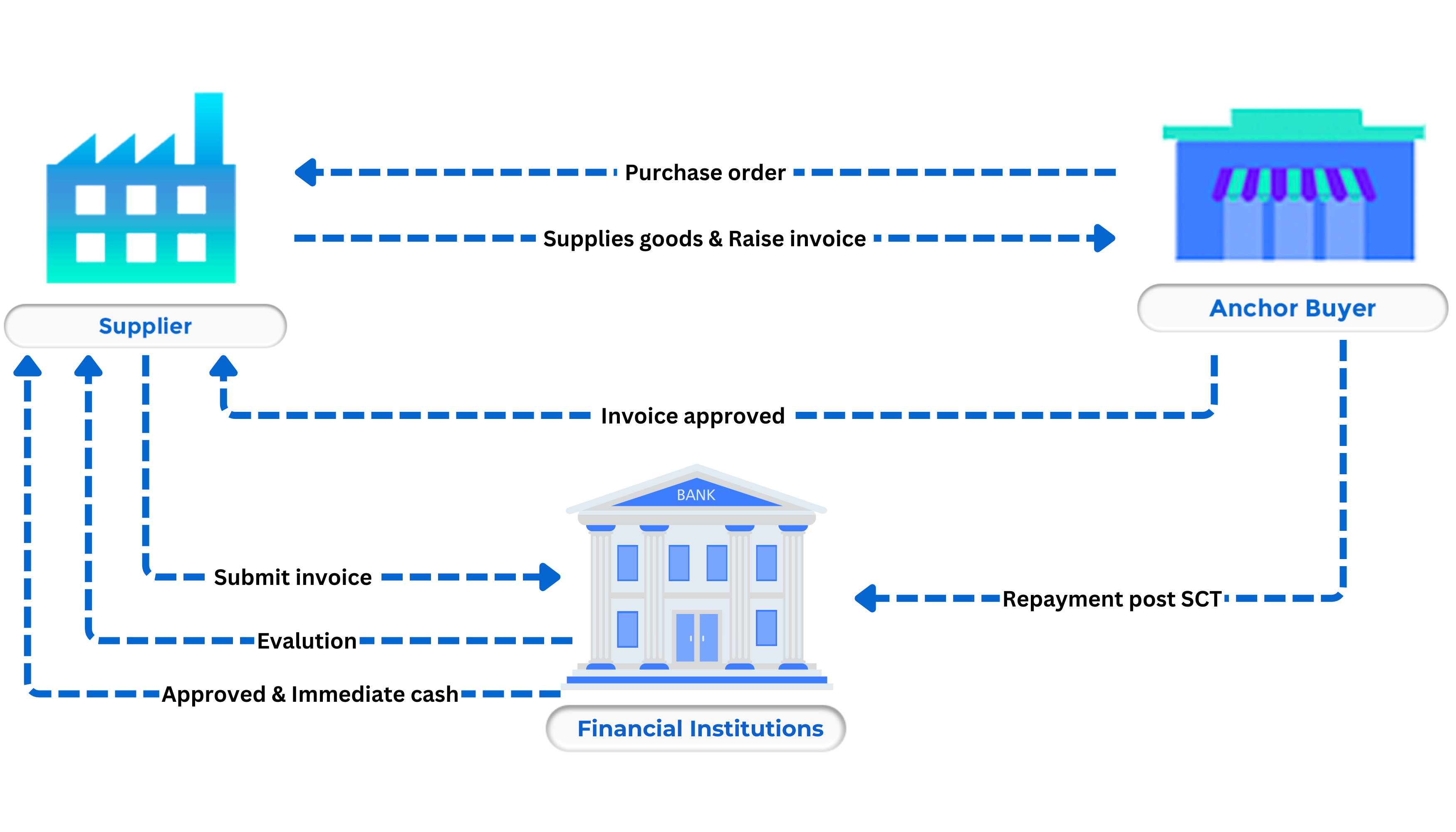

RECEIVABLE FINANCE

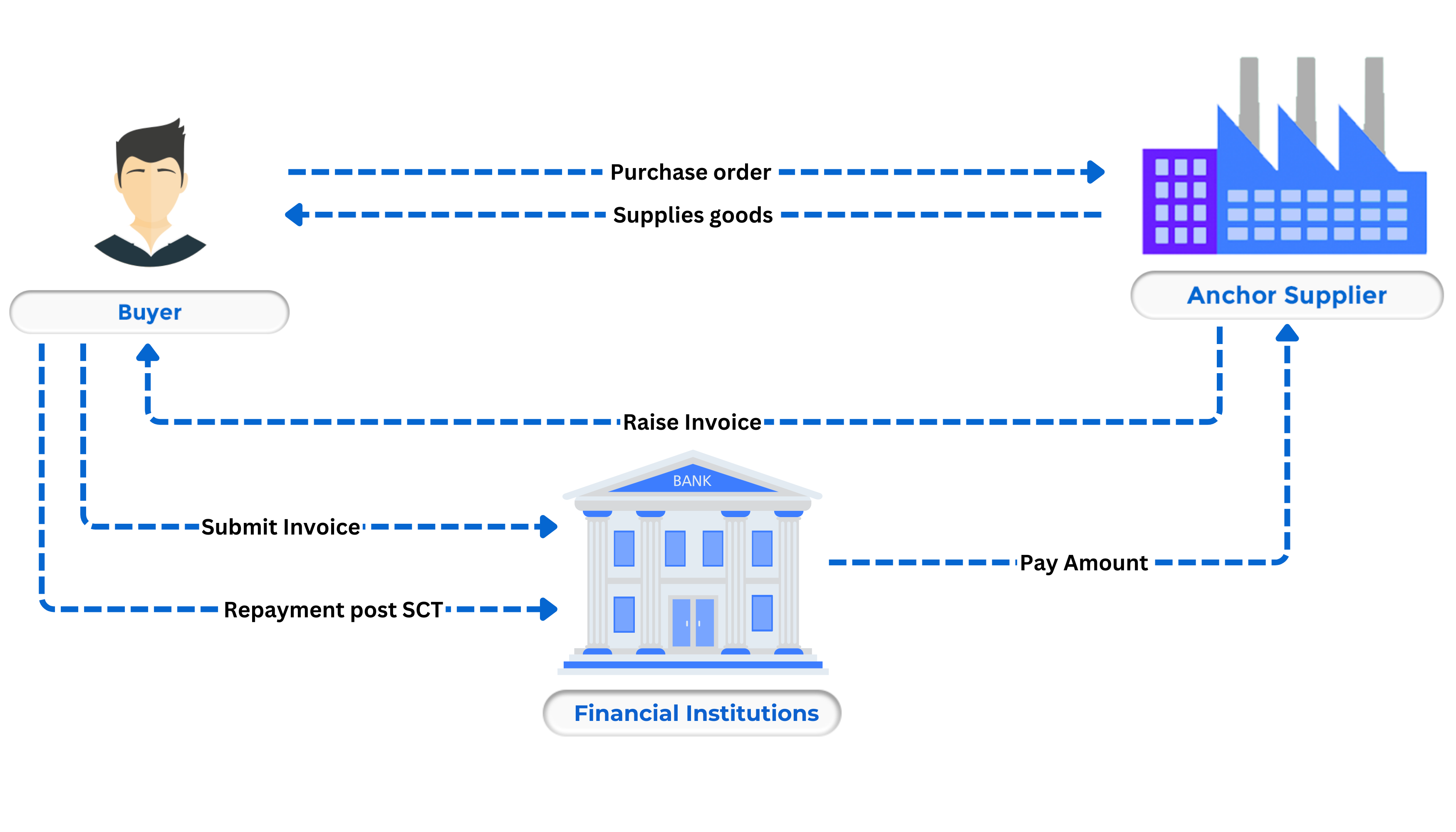

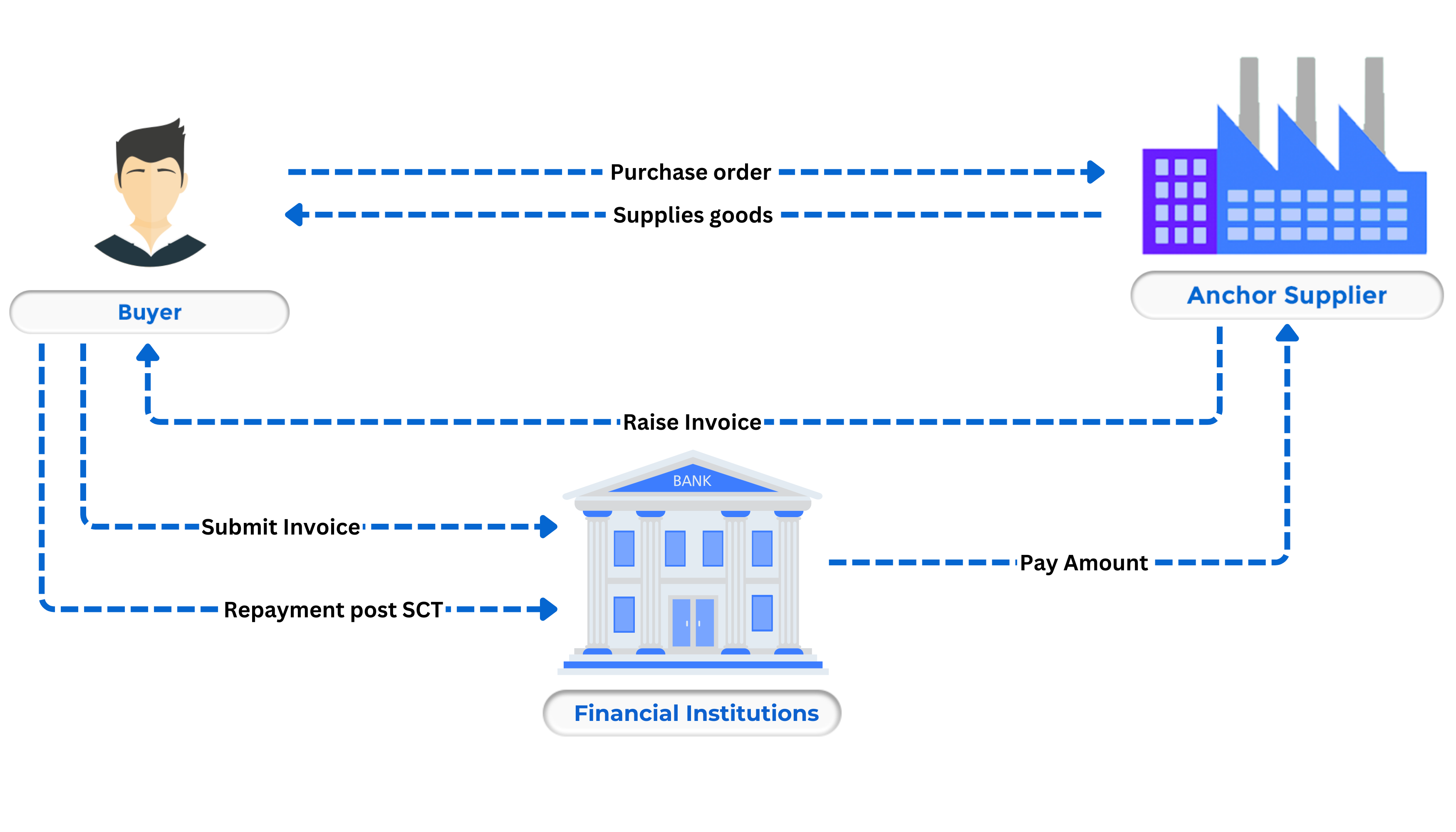

DEALER FINANCE

Features of SCF

- Registration and onboarding of financial institutions.

- Creation and management of Anchor Buyers and Anchor Suppliers.

- Digitization of invoice details with credit limit settings for Anchor Buyers and Suppliers by financial institutions.

- Verification and sanctioning of loans against approved invoices.

- Bulk upload and update of disbursement and repayment details.

- Dynamic adjustment of credit limits based on disbursement and repayment activities.

- Comprehensive reports and dashboards for tracking and analysis.